We do not include the universe of companies or financial offers that may be available to you.īankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. But this compensation does not influence the information we publish, or the reviews that you see on this site. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. The offers that appear on this site are from companies that compensate us.

#AMORTIZED MORTGAGE FOR FREE#

Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.īankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover. Keep in mind that when you take longer to pay off your mortgage, you pay more in interest.We are an independent, advertising-supported comparison service. The longer your amortization period, the lower your payments will be. How your amortization period affects your costs Learn more about mortgage prepayment penalties. If you plan on moving in the near future, a shorter term may be better for you. When choosing the length of your term, consider your life situation. This amount could be thousands of dollars. It also depends on the conditions of your mortgage contract. The amount you pay depends on the type of mortgage you have.

#AMORTIZED MORTGAGE FULL#

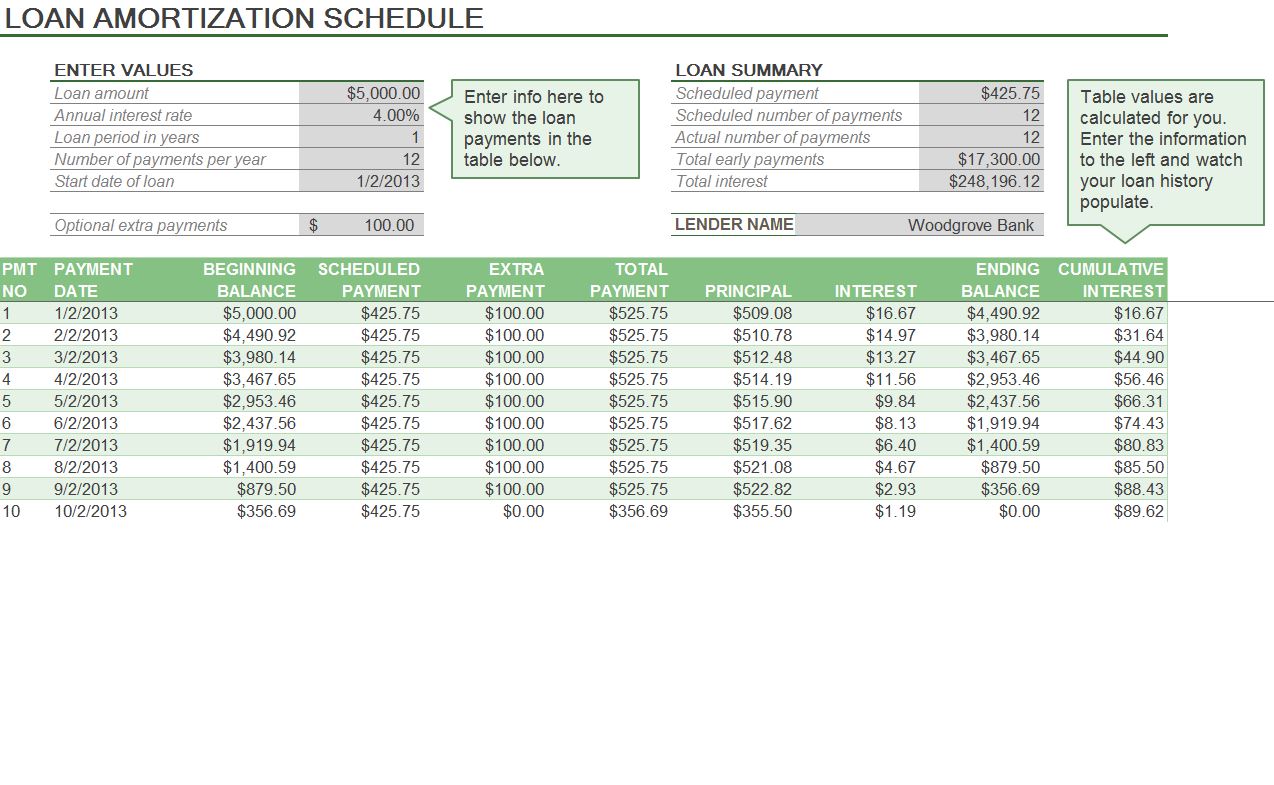

If you renegotiate your mortgage contract or pay your mortgage in full before the end of the term, you may have to pay a prepayment penalty. Talk to your lender or mortgage broker to see if you can negotiate a lower interest rate. Shop around to get the best interest rate for your mortgage term. Your payments are higher if your interest rate is higher.įigure 2: Example of monthly mortgage payments for a mortgage of $300,000 with an amortization of 25 years at various interest rates Your interest rate has an impact on your mortgage payments. The interest rates offered by lenders typically increase as the term length increases. Lenders normally offer different interest rates for different mortgage term lengths. A variable interest rate can change during your term. A fixed interest rate stays the same through the duration of your term.

Your mortgage can have a fixed or a variable interest rate. Your mortgage term sets the interest rate and the type of interest for a set period. How your mortgage term affects your costs Interest Typically, the new interest rate will be the one offered by the lender for the longer term. Once the mortgage is converted or extended, the interest rate changes.

lock-in an interest rate for a longer period of time.The lengthier the term, the longer you keep the conditions of your current mortgage contract. Longer-term mortgages are mortgages with a term greater than 5 years. take advantage of a lower interest rate when you sign up.opt for a fixed or a variable interest rate.With a shorter-term mortgage term, you may: The shorter the term, the sooner you renew your mortgage contract. Most mortgage holders in Canada have a mortgage term of 5 years or less, also known as a shorter-term mortgage. The length of your mortgage term impacts your interest rate. Mortgage terms can range from a few months to 5 years or more. If your down payment is less than 20% of the price of your home, the longest amortization you’re allowed is 25 years.įigure1: Example of a mortgage of $300,000 with a term of 5 years and amortization of 25 years The amortization is an estimate based on the interest rate for your current term. The amortization period is the length of time it takes to pay off a mortgage in full. If you pay your mortgage balance at the end of your term, you don’t need to renew your mortgage. You’ll likely require multiple terms to repay your mortgage in full. Terms can range from just a few months to five years or longer.Īt the end of each term, you must renew your mortgage. This includes everything your mortgage contract outlines, including the interest rate. The mortgage term is the length of time your mortgage contract is in effect. When you shop around for a mortgage, you need to decide on the mortgage term and amortization period.

0 kommentar(er)

0 kommentar(er)